You can run a balance sheet report easily if you use QuickBooks.

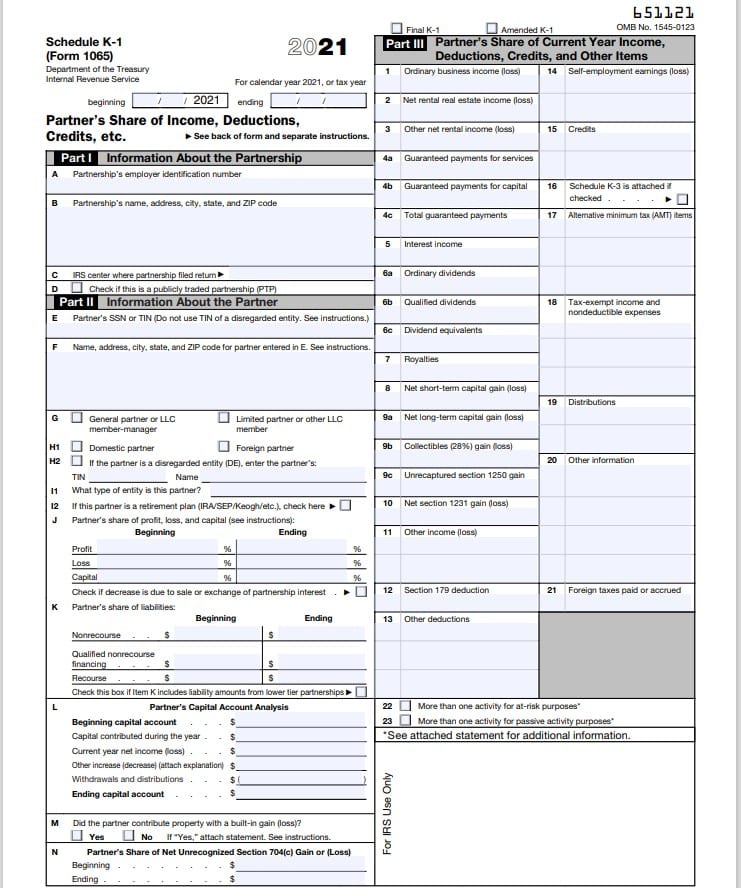

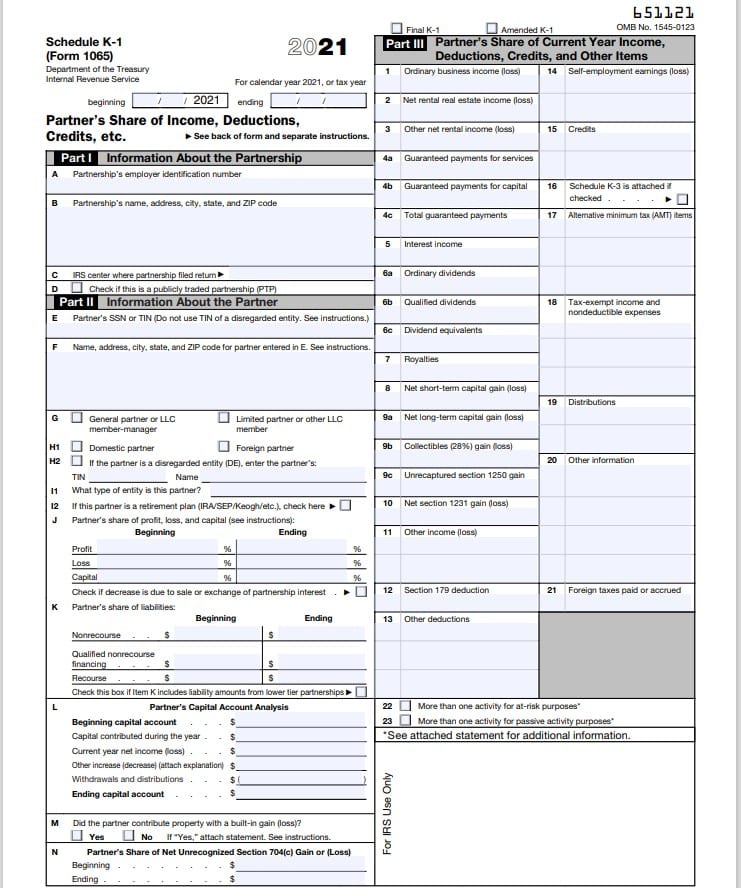

Balance sheet statement: Summarizes the assets, liabilities, and owner’s equity as of the end of the tax year. If you use an accounting program like QuickBooks, you can run a P&L report in a few minutes. Profit and loss (P&L) statement: Summarizes the partnership’s income and expenses for the tax year and calculates the bottom line net P&L. The information and reports needed to prepare Form 1065 for a partnership include: Our free Form 1065 checklist will help you gather this information. Gather Information Needed to File Form 1065īefore preparing Form 1065, you need financial statements for the tax year, information for each of the partners, and in-depth details about fixed assets and tax payments. Lastly, each partner will need to fill out a Schedule K-1 reflecting their share of income, deductions, credits, and other items.ĭownload Form 1065 from the IRS and follow along with our steps. Then, you’ll fill out the general information and income and deduction sections of the form before completing Schedules B, K, L, M-1, and M-2 (found on pages 2–5). The first step is to gather all the information you’ll need to fill out Form 1065 ( download checklist here).

The penalty for a late or incomplete Form 1065 is $210 per month times the number of partners in the partnership. While Form 1065 doesn’t generate a tax liability, it’s very important to complete it on time and accurately.

Multimember limited liability companies (LLCs) not being taxed as S corporations (S-corps) also must file Form 1065. Form 1065 is the tax return used by partnerships to report business income and expenses.

0 kommentar(er)

0 kommentar(er)